Spanish police arrested five people tied to a $541 million crypto scam. Europol called it one of the biggest scams in Spain’s crypto history.

Over 5,000 investors were tricked through a fake investment network using crypto transfers, offshore companies, and false banking setups.

🔍 What Happened

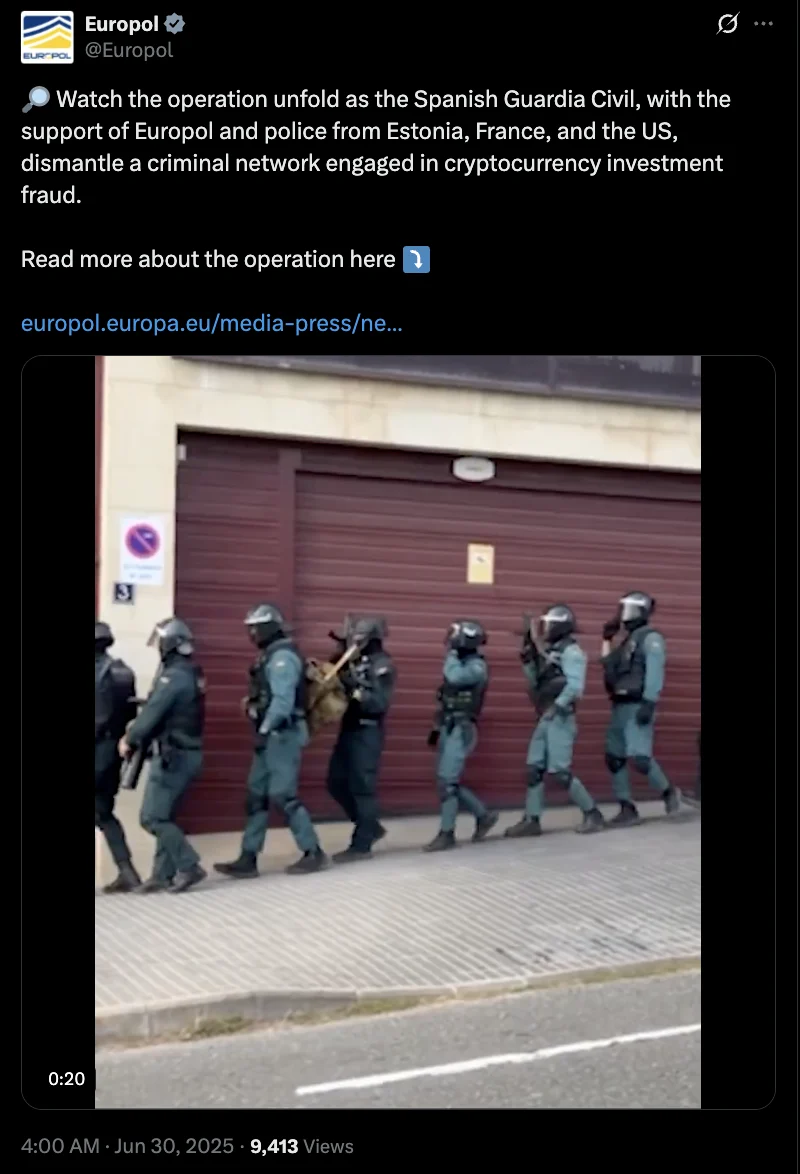

Europol announced Monday that Spanish law enforcement arrested five suspects involved in a large-scale crypto investment fraud scheme.

Three arrests were made on the Canary Islands, and two more in Madrid. Authorities also searched related properties and seized evidence.

The operation was backed by Europol, the U.S., France, and Estonia. Together, they helped track and uncover how the fraud ring operated across borders.

According to the report, the group used false promises of crypto profits to lure in victims. Over €460 million ($541M) was stolen from more than 5,000 individuals.

🧠 How the Scam Worked

The criminal group posed as a legitimate crypto investment operation. But behind the scenes, they built a complex system of shell companies, fake user accounts, and crypto wallets.

They reportedly:

- Used Hong Kong–based companies to hide funds.

- Created false banking networks to send and receive payments.

- Operated under different names across crypto exchanges.

- Collected money via cash, bank transfers, and crypto.

“Investigators suspect the criminal organization of having set up a corporate and banking network based in Hong Kong, allegedly using payment gateways and user accounts in the names of different people and in different exchanges to receive, store, and transfer criminal funds,” Europol stated.

This wasn’t a small-time scam. It was a global fraud network built for large-scale theft.

📊 Why It Matters

Crypto scams have evolved. This case shows how organized networks now use international banking systems, multiple exchanges, and legal loopholes to move stolen money.

This is not an isolated case. In January, Spanish authorities froze over $26 million in digital assets tied to crypto-linked money laundering.

Globally, law enforcement is now targeting these complex fraud rings more aggressively.

Earlier this month, the U.S. Department of Justice seized $225 million in a similar crypto fraud known as pig butchering, where scammers groom victims over time before draining their wallets.

💬 Quotes Section

“To carry out their fraudulent activities, the leaders of the criminal network allegedly used a net of associates spread around the world to raise funds through cash withdrawals, bank transfers, and crypto-transfers,” Europol said in its report.

💼 What It Means for Investors

This case is a reminder that crypto fraud isn’t always about phishing or fake tokens. It now includes well-structured operations using legal firms, offshore payments, and blockchain tech to bypass detection.

Traders and holders should:

- Stay alert to “too good to be true” investment offers.

- Research platforms before sending funds.

- Be cautious with offshore firms or anonymous operations.

Losses like this shake investor confidence, especially among newcomers. It’s also a wake-up call for regulators and exchanges to improve identity verification and fund tracking.

📅 Conclusion

Spain’s $541 million crypto fraud bust highlights the growing scale of organized crypto crime.

With more seizures and arrests happening globally—from Europe to the U.S.—the crypto market is facing increased scrutiny and legal oversight.

Is this a sign that regulators are finally catching up with crypto crime? Or just the beginning of a larger clean-up?

Keep an eye on further developments as Europol’s investigation continues.