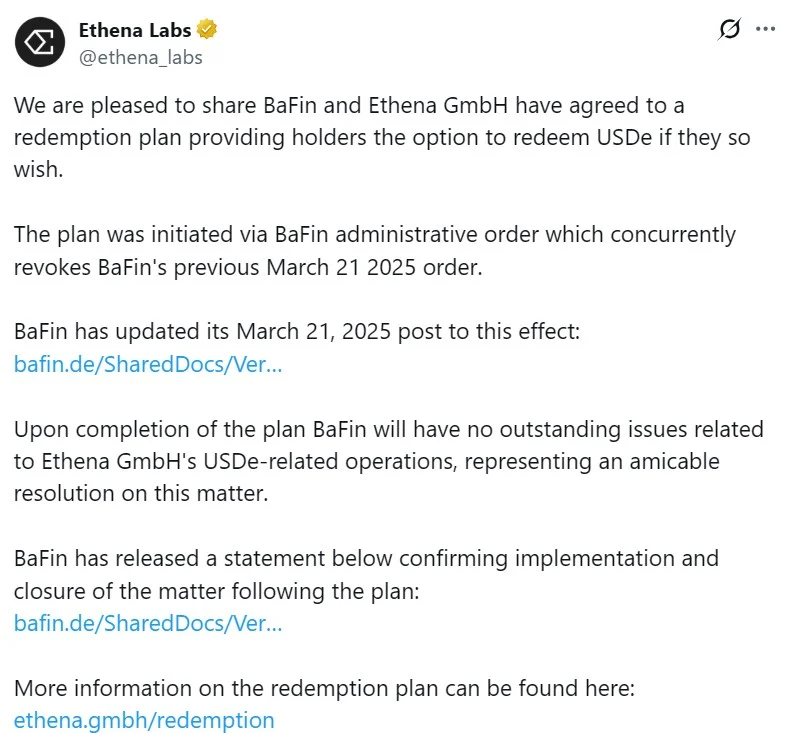

Germany’s BaFin has closed its case against Ethena GmbH after agreeing to a 42-day redemption plan for USDe holders. The move ends a months-long regulatory standoff and clears the path for a wind-down of Ethena’s German operations.

What Happened

On Wednesday, Ethena Labs said it reached an agreement with Germany’s financial regulator, BaFin, over the redemption of its USDe stablecoin. The 42-day window will let users claim their holdings directly from Ethena GmbH until August 6.

BaFin appointed a special representative to oversee the process. After the deadline, Ethena GmbH will be officially dissolved within Germany, the EU, and the EEA.

From August 7, all future claims must be directed to Ethena (BVI) Ltd., the firm’s offshore affiliate.

Ethena Labs said once the redemption period ends, there will be no outstanding issues related to Ethena GmbH’s USDe operations. It did not confirm any plans to re-enter the EU market.

Why It Matters

This wraps up a four-month clash between Ethena Labs and German authorities.

Back in March, BaFin ordered Ethena GmbH to stop issuing USDe in Germany, citing breaches of MiCA rules. It claimed the company offered unregistered securities via its yield-bearing sUSDe tokens, which are tied to USDe.

The crackdown included:

- Freezing reserve assets

- Taking down the firm’s website

- Blocking new users from accessing services

Ethena stopped operations in Germany by April 15, withdrawing its MiCA authorization bid.

BaFin had rejected the firm’s license application in March 2024, citing regulatory gaps. Ethena GmbH had not minted or redeemed any USDe since BaFin’s enforcement on March 21.

Despite the conflict, nearly 5.6 billion USDe tokens remain in global circulation. Most were issued before MiCA took effect and sit outside EU jurisdictions.

Quotes Section

“USDe holders will have until Aug. 6 to declare redemption claims directly against Ethena GmbH,” BaFin said in the announcement.

Ethena Labs added, “After the redemption plan is fully implemented, Ethena GmbH will have no outstanding issues related to Ethena GmbH’s USDe-related operations.”

Investor Angle

For now, the USDe stablecoin remains active via Ethena’s offshore structure. But EU traders and protocols may face hurdles accessing or integrating it going forward.

No new minting or redemptions are expected from the EU side. This also narrows DeFi exposure in the region tied to USDe and sUSDe yield tokens.

The stablecoin’s offshore pivot mirrors broader trends as regulators tighten control over crypto inside Europe.

Conclusion

The BaFin-Ethena conflict is closed, but questions remain.

Will Ethena attempt a fresh license bid in another EU country? Or is the door now closed for USDe in regulated markets?

For now, all eyes turn offshore—where Ethena continues operations free of MiCA oversight.