Circuit has unveiled a new crypto recovery system for lost crypto assets, targeting institutional players wary of irreversible loss. The move aims to ease a key barrier to mass adoption—what happens when private keys vanish for good.

What Happened : Crypto Recovery System

Crypto recovery startup Circuit has launched its institutional-grade recovery engine, designed to prevent permanent asset loss. Powered by Automatic Asset Extraction (AAE) technology, the system automatically shifts digital assets to a secure vault if a threat is detected or a private key is lost.

The product is already live with two institutional users—UAE-based custodian Tungsten and Palisade, a custody infrastructure provider that serves exchanges and tokenization platforms.

CEO Harry Donnelly said the platform addresses a growing institutional need: reliable recovery mechanisms.

“The permanent loss of assets is one of the biggest barriers to mainstream adoption,” Donnelly told Cointelegraph.

Market Insight—Why It Matters:

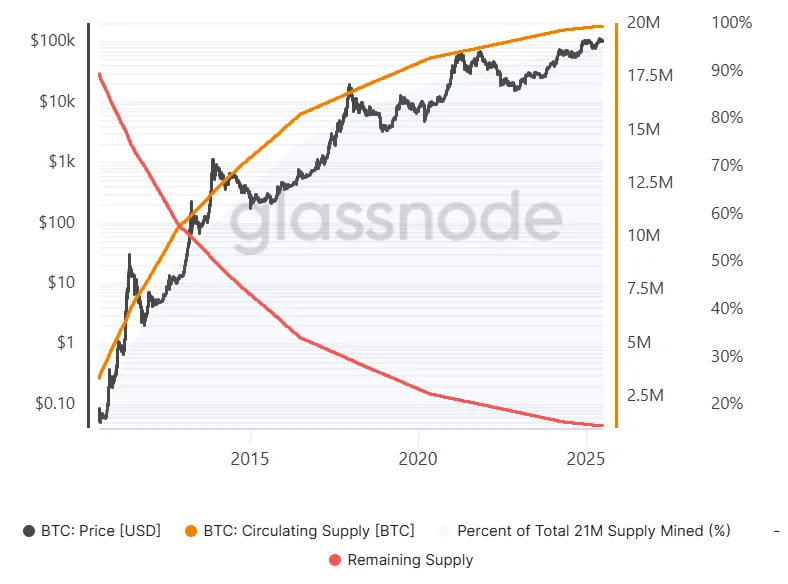

Lost crypto isn’t just a personal problem—it’s a systemic issue. Around 2.3 to 3.7 million BTC (11–18% of total supply) is believed to be lost forever, according to Ledger.

For institutions, that’s a red flag. Unlike retail holders, big firms face fiduciary responsibility and need safety nets.

“Institutions view asset recovery as a fundamental requirement, not a nice-to-have,” said Donnelly.

Bitcoin’s appeal as a bearer asset—meaning whoever holds the key holds the coin—comes with a major risk: there’s no reset button. While that excites die-hards, it terrifies traditional finance.

The Custody Problem—and Circuit’s Pitch:

Most people still rely on centralized custodians because self-custody is risky and complex. Circuit is offering a hybrid approach—enterprise-grade automation with recovery baked in.

That could be critical as more regulated players join the market, especially with upcoming Ethereum ETFs, MiCA rules in Europe, and the steady rise in tokenized real-world assets.

Donnelly believes better tooling will smooth the road.

“Most people aren’t equipped for true self-custody; it’s technically complex and comes with irreversible risks,” he said.

The Bitcoin “Donation” Debate:

Bitcoiners often shrug off lost coins as a “donation” to other holders—reducing supply and possibly lifting price.

Donnelly doesn’t buy it.

“The idea that lost Bitcoin is just a ‘donation’ to other holders doesn’t sit well” for institutional users, he said.

The recovery engine doesn’t change Bitcoin itself. But for large holders, especially funds and custodians, it offers a backup plan when things go sideways.

Investor Angle:

While this announcement didn’t move Bitcoin’s price, it signals a trend: more institutional-grade infrastructure. If widely adopted, recovery systems could make high-value firms more comfortable holding crypto directly.

That could lift custody-focused tokens or boost demand for multi-sig and recovery-linked services.

Conclusion:

Circuit’s launch may not thrill purists, but for big money, it’s a needed bridge. If institutions gain confidence and don’t lose billions over a lost key, crypto’s next adoption wave could hit sooner than expected.

Will more custody innovations like this help unlock crypto’s next $1 trillion in inflows?

Ask ChatGPT.