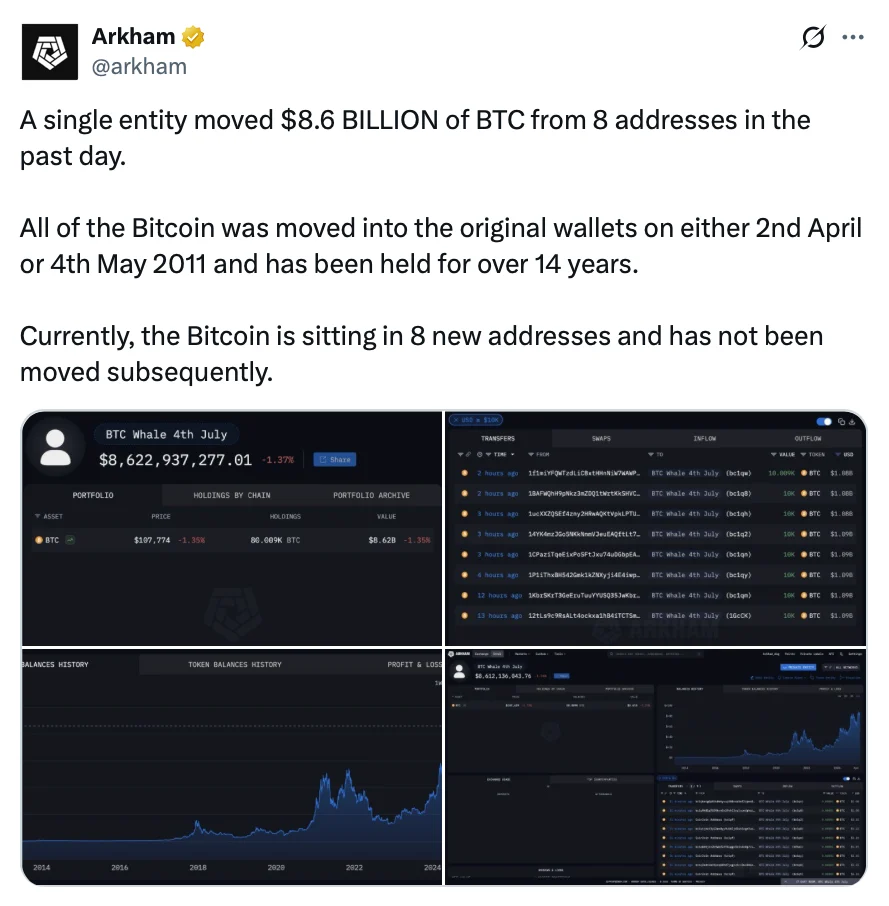

Nearly $8.6 billion worth of Bitcoin was quietly moved on Thursday from wallets dormant since 2011. A Coinbase executive says there’s a slim chance this was a massive hack—possibly the biggest in history. Whether it was a private whale or a compromised key, this move has the crypto world watching closely.

📘 What Happened:

Eight old Bitcoin wallets—each untouched for over 14 years—suddenly transferred nearly 80,000 BTC to eight brand-new wallets.

The funds, originally received in April and May 2011, had remained inactive until this July 4 move, catching the attention of analysts and blockchain watchers.

Conor Grogan, head of product at Coinbase, flagged the activity in a post on X (formerly Twitter), suggesting a “small possibility” the private keys were compromised.

“There is a small possibility that the $8B in BTC that recently woke up were hacked or compromised private keys,” said Grogan.

Adding to the suspicion, Grogan noticed a single Bitcoin Cash (BCH) transaction from one of the related addresses just 14 hours before the main Bitcoin movement.

“I found a single BCH test transaction from one of the BTC whale clusters 14 hours ago, followed by the full amount,” he wrote.

That test transaction might indicate someone was checking if the private key still worked, but it also raised concerns of potential key theft.

📊 Market or Technical Insight:

Blockchain analytics firm Arkham later confirmed that the $8.6 billion in BTC came from eight wallets and now rests in eight new ones.

No further movement has occurred since.

There’s no sign of mixing, exchange deposits, or breakup of the coins—a typical move if funds were stolen.

This is what makes the move more mysterious. If it were a hacker, why just move the BTC and not touch the related BCH wallets?

Grogan himself acknowledged the irregular pattern:

“What makes me say this is the other BCH wallets have not been touched at all; why wouldn’t they also sweep these?”

From a technical view, the movement is clean. The transaction fee was average. There were no mixing tools, no use of privacy chains—just straight wallet-to-wallet transfers.

Bitcoin’s price stayed largely stable, down only 1.02% in the 24 hours after the move. It’s currently trading at $108,150, per CoinMarketCap.

🗣️ Quotes:

“If true (again, I’m speculating on straws here), this would be by far the largest heist in human history,” said Conor Grogan, Head of Product at Coinbase.

“I found a single BCH test transaction from one of the BTC whale clusters 14 hours ago, followed by the full amount. An hour later, the BTC wallets began to move,” he added.

💡 Investor Angle:

While markets didn’t panic, the move triggered whale alert systems and renewed concerns about key security for early wallets.

Traders may want to monitor addresses flagged by Arkham for signs of further movement. If this turns out to be a hacker, we could see the BTC enter mixers or hit OTC desks.

If the owner is legitimate, we might be seeing an old-school holder preparing to sell, stake, or secure their funds post-halving.

✅ Conclusion:

The crypto world has seen its share of wallet reactivations—but not on this scale. Whether this is a calculated whale move or history’s biggest heist, it’s a major on-chain event.

Next watch: If the new wallets start splitting or sending BTC to exchanges, that will tell us more.

Until then, one question remains:

Did a 2011 Bitcoin whale wake up—or did someone else break in?