Bitcoin ETFs See Record $588M June Inflow, 11-Day Streak

Bitcoin ETFs had their best June day ever—$588.6 million—11 days in a row. The rally follows a Middle East ceasefire, easing market fears and crypto demand.

Bitcoin ETFs Pull in $588M, Led by BlackRock

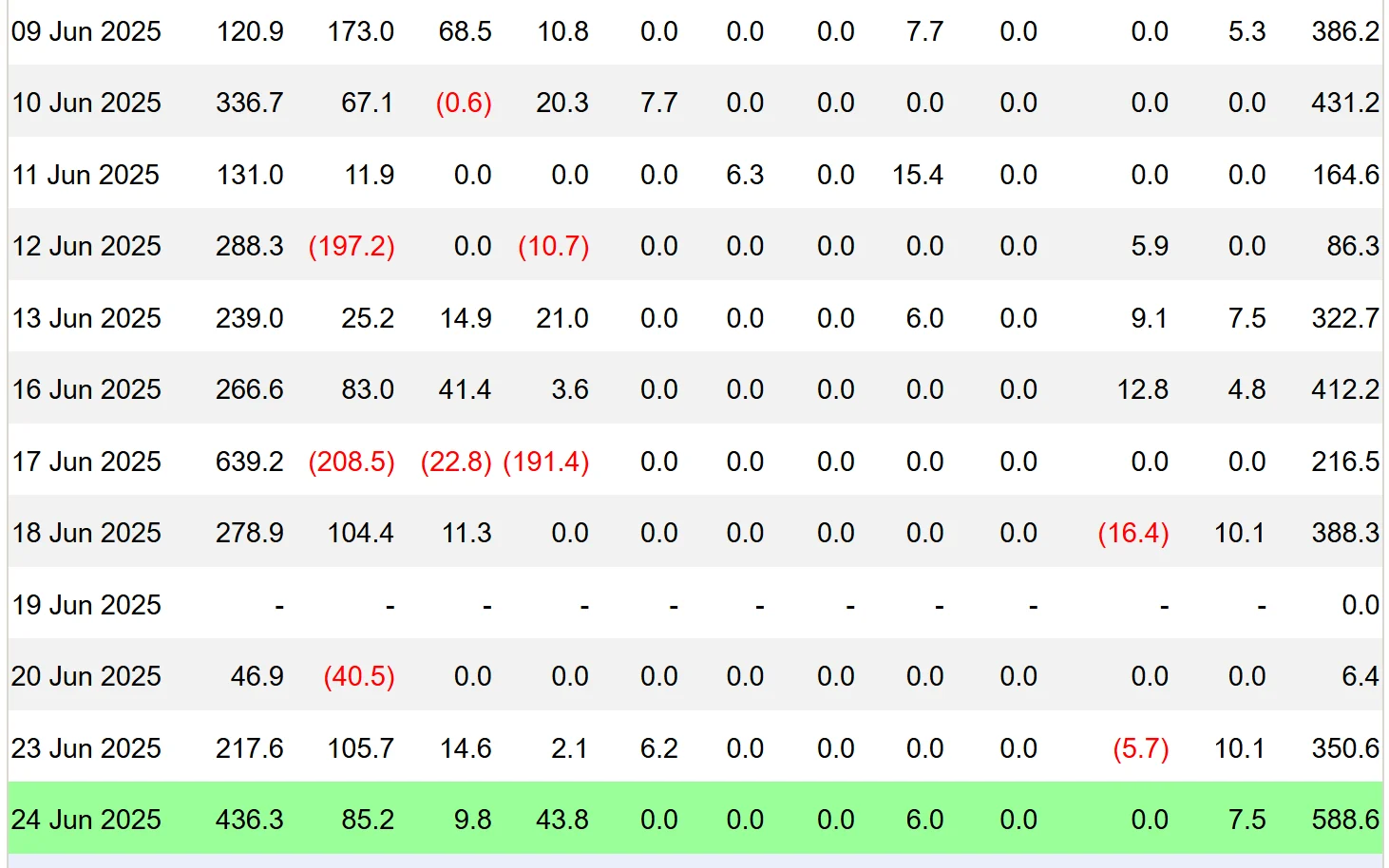

U.S. spot Bitcoin ETFs had their best June day on Tuesday, $588.6 million, according to Farside Investors. 11 days in a row of inflows, the longest since December 2024.

BlackRock’s iShares Bitcoin Trust (IBIT) led the way with $436.3 million. Fidelity’s FBTC, $217.6 million. Bitwise and VanEck, minor gains. Grayscale’s GBTC, $85.2 million outflows.

Total U.S. Bitcoin ETFs have seen $2.2 billion since June 10.

This is deepening institutional confidence in Bitcoin, even with macro uncertainty.

Ceasefire Eases Nerves, Bitcoin Rises

An Israel-Iran ceasefire seems to have sparked buying.

U.S. President Donald Trump’s “complete and total ceasefire” announcement Tuesday sent markets into relief mode. Bitcoin rose from around $98,000 to over $106,800.

The ceasefire reduced risk aversion, giving investors room to get back into volatile assets like crypto.

Vincent Liu, CIO of Kronos Research, says the inflows point to a bigger trend:

“Persistent inflows into spot Bitcoin ETFs show that BTC is digital gold. Investors are seeking stability through scarcity,” said Liu.

Ethereum ETFs Mixed, Grayscale Sees More Outflows

While Bitcoin led the way, Ethereum ETFs were mixed.

VanEck’s EFUT, $98 million in inflows. Grayscale’s ETHE, $26.7 million in outflows. The divergence is similar to sentiment across Ethereum assets: interest exists, but not as strong as Bitcoin.

Relief Rally or For Real? Not everyone thinks this is a full recovery.

Ray Youssef, CEO of NoOnes, says this is just a breather:

“The rally felt like the market ‘exhaling after a period of sustained tension,’” said Youssef.

He expects Bitcoin to stay range-bound for now. Resistance is near $106,200. If $100K fails, $93K is on the table.

Investors are also watching Fed Chair Jerome Powell’s testimony and Friday’s PCE inflation report—both could move the market.

What to Watch

Over $2.2 billion has gone into spot Bitcoin ETFs in two weeks; institutional demand is clear. But macro is still in control.

Upcoming economic data and Fed signals will determine if Bitcoin breaks out or pulls back.

Will ETF demand push Bitcoin higher, or will macro hit the brakes again?