Eight major South Korean banks are joining forces to launch a won-backed stablecoin by 2026. The move is to reduce dependence on the US dollar in digital finance and make Korea a global crypto player.

South Korea’s Banks Enter the Stablecoin Game

A group of South Korea’s biggest banks is preparing to launch a stablecoin pegged to the Korean won. The joint effort includes KB Kookmin, Shinhan, Woori, Nonghyup, Corporate, Suhyup, Citi Korea, and SC First Bank.

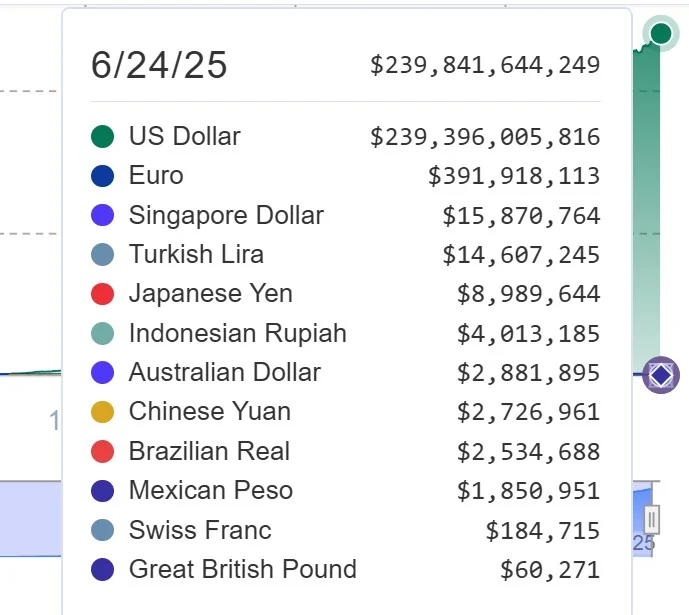

This is a direct response to the growing dominance of US dollar-backed stablecoins. Dollar tokens now make up 99% of the $239 billion stablecoin market, according to RWA.xyz.

By developing a domestic stablecoin, these banks want to protect Korea’s monetary sovereignty and reduce exposure to dollar-driven liquidity in the global crypto space.

Launch Date: Late 2025 or Early 2026

The banks plan to launch the stablecoin by the end of 2025 or early 2026, according to Econovill.

This will be the first large-scale move by South Korean traditional banks into digital assets. The project will be supported by the Korea Financial Telecommunications and Clearings Institute, with backing from blockchain groups like Open Blockchain and the Decentralized Identity Association.

The stablecoin will reportedly follow a trust-based model or a 1:1 deposit token system. Both frameworks are under review and require regulatory clearance.

New Regulations to Support the Shift

The stablecoin plan aligns with South Korea’s broader effort to regulate digital assets.

On June 10, the ruling party proposed the Digital Asset Basic Act, which will allow licensed stablecoin issuance and provide a legal framework for crypto growth.

This law will give banks and tech firms clearer rules to enter the token economy while addressing investor protection and transparency.

Central Bank Cautious

Bank of Korea Governor Rhee Chang-yong acknowledged the benefits but warned that a won-pegged stablecoin could make capital outflows to dollars easier.

That, he said, could weaken the Korean won and complicate monetary policy. But he didn’t oppose the plan. Deputy Governor Ryoo Sangdai was more positive. He suggested a phased rollout, starting with bank-issued stablecoins to ensure risk controls are in place from the beginning.

Why It Matters to You and the Market

South Korea is one of the most active crypto markets in Asia, with growing retail and institutional interest.

A state-backed, bank-issued won-pegged stablecoin will give local traders a stable on-chain unit without relying on dollar-denominated tokens like USDT or USDC. It will also set a precedent for other countries to issue fiat-pegged assets through private banks instead of central banks.

The big question now: Can Korea’s stablecoin break the dollar’s hold on crypto liquidity—or will it be a local hedge in a dollar-dominated world?