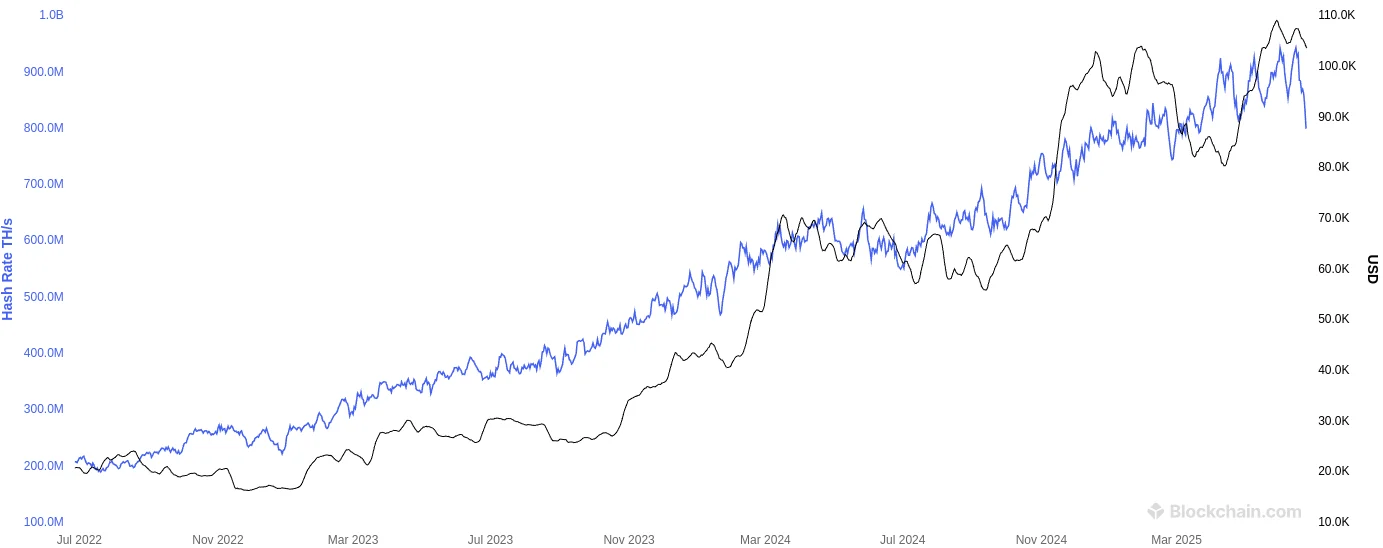

Bitcoin’s hashrate fell 15% from June 15 to 24, the biggest drop in 3 years. The decline is sparking talk of mining slowdowns due to rising power costs, extreme heat, and possible geopolitical fallout.

What Happened

Bitcoin’s network hashrate dropped from around 943.6 EH/s to 799.9 EH/s in 9 days, according to Blockchain.com. That’s a 15.2% drop, the biggest since China’s mining crackdown in 2021.

This hasn’t been seen since May, so mining stability and long-term network resilience are being questioned.

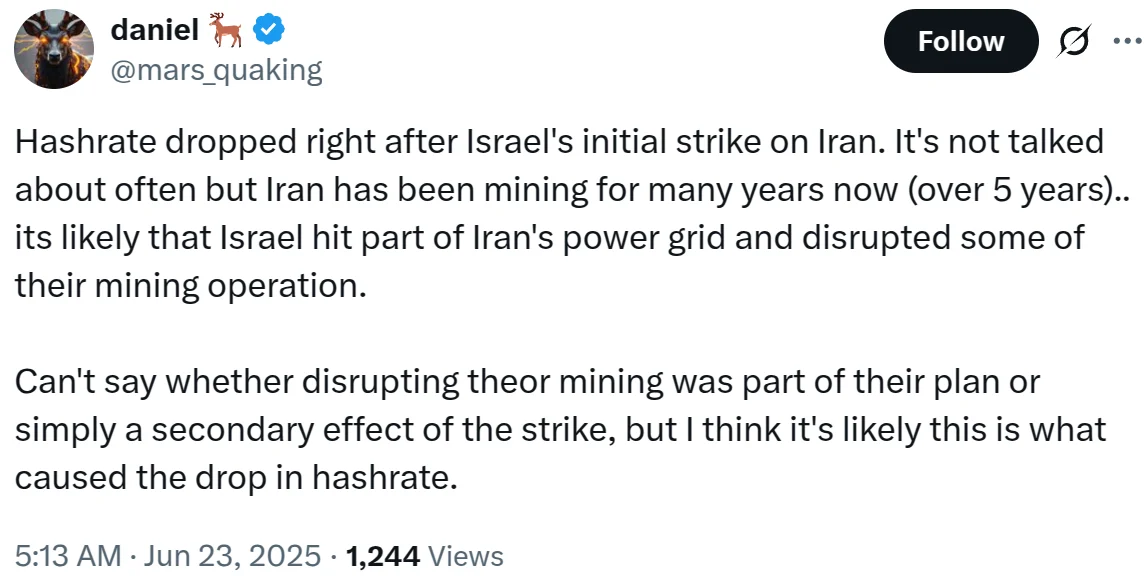

Much of the speculation is around power outages and an internet blackout in Iran, a known hub for state-protected Bitcoin mining farms. On June 20, Iran shut down most of its internet following reports of cyberattacks. That same day, Bitcoin’s global hashrate fell from 884.6 EH/s to 865 EH/s—a 2.2% drop.

The drop continued through June 22, coinciding with a reported US airstrike on Iranian nuclear sites that caused additional electric grid issues. From June 21 to 22, hashrate dropped another 1%.

Why It Matters

Hashrate is the total computing power securing the Bitcoin network. A drop of this size can:

- Lower mining difficulty in the next adjustment.

- Slow down block production, affecting transaction times

- Signal operational stress at large mining farms

- Create short-term security concerns for the network.

But the Iran theory doesn’t fully explain the drop. The network was already down 6.2% before June 20.

Environmental factors likely played a big role.

The US heatwave put pressure on the electric grid, especially in mining hotspots like Texas. Power demand surged. Mining rigs in low-profit regions may have shut down to avoid losses. Utility company Con Edison asked New Yorkers to reduce energy usage, citing record demand and skyrocketing prices.

Mining & Market Insight

Hashrate isn’t directly tracked like price. It’s estimated based on the average time to mine blocks and current network difficulty. So day-to-day readings can be noisy.

But this sudden drop is real-world disruption, not just random fluctuation. So far, the Bitcoin price hasn’t moved much. It’s hovering around $61,000 as of June 24 with no big moves tied to the hashrate drop.

Investor Takeaway

Traders watching mining-related tokens should be cautious. Coins like Marathon Digital (MARA) and Riot Platforms (RIOT) tend to react to mining performance and network trends.

Any hashrate bounce could support better mining margins, but the heat and geopolitical risks will keep miners under pressure.

Conclusion

With no clear single cause, the hashrate drop is likely a mix of power stress, heatwaves, and regional conflicts. If energy prices stay high and weather extremes persist, more mining will be cut back.

The next hashrate adjustment is due in days—watch how the network adjusts.

Will it stabilize, or is this the start of a deeper slowdown?