The FATF warned global regulators about rising crime linked to stablecoins. But top blockchain intelligence firms say this isn’t an attack on crypto—it’s a push for better regulation. With stablecoins now making up the majority of illicit on-chain flows, enforcement and transparency are becoming urgent for the industry’s long-term credibility.

📉 What Happened

The Financial Action Task Force (FATF) issued a strong warning on Thursday, urging regulators worldwide to tighten oversight on it’s activity. The group raised concerns that mass adoption of stablecoins without clear rules could increase illicit use, especially across borders.

According to FATF, the solution isn’t banning stablecoins but applying real-time monitoring, stronger supervision, and unified licensing standards across countries.

Despite the tone, blockchain intelligence firms say the warning isn’t anti-crypto. Instead, it reflects the growing need for accountability as stablecoins become a core part of global value transfer—both legal and illegal.

📊 Market or Technical Insight:

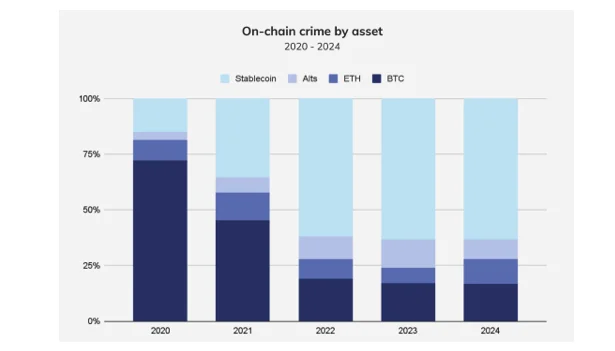

Stablecoins now dominate illicit crypto flows.

63% of all on-chain criminal transactions involve stablecoins, according to Chainalysis’s upcoming “2025 Crypto Crime Report.” That’s more than Bitcoin, Ethereum, or other altcoins combined.

Jordan Wain, policy adviser at Chainalysis, says the data highlights a clear need:

“Stablecoins are the dominant form of crypto asset for transacting value as well as for undertaking illicit activity.”

The transparency of stablecoins—which live on public blockchains—actually makes them easier to track than some privacy coins. But many are issued by centralized firms, which brings both a risk and a solution.

When regulators act, stablecoin issuers can freeze funds. This has already happened with Tether, which froze $225 million in USDT in 2023 after U.S. authorities flagged links to scams.

🗣️ Quotes :

Aidan Larkin, co-founder of Asset Reality, said the FATF move is about building trust:

“That’s not anti-crypto. It’s a recognition that credibility and growth depend on regulation that actually works.”

He added:

“[The] FATF isn’t calling for a ban on stablecoins. It is calling for visibility and better enforcement.”

Larkin also warned that blockchain monitoring alone won’t stop bad actors:

“Monitoring on-chain behavior is only part of the equation. Enforcement in the form of secondary sanctions has been debated…”

🌍 North Korea Spotlight – ZachXBT’s Alarming Find:

In response to FATF’s specific call for more scrutiny of North Korean stablecoin activity, crypto sleuth ZachXBT revealed troubling findings.

He said on X (Twitter) that Circle’s USDC is the “primary infra used by DPRK IT workers to facilitate payments.”

He claims there are “high eight-figure” volumes in suspicious activity and accuses Circle of inaction, saying the firm “does nothing to detect or freeze the activity while boasting about compliance.”

So far, Circle hasn’t commented.

Earlier this year, they did freeze $57 million in USDC tied to another federal court request. But not in the North Korea case—yet.

💰 Investor Angle:

For crypto investors, this is a double-edged story.

Yes, regulators are watching closely. That adds friction. But it also signals stablecoins are too important to ignore.

The industry must now prove it can balance utility with compliance. Expect more pressure on centralized issuers like Circle and Tether, especially after their history of fund freezes.

This also raises compliance risk for DeFi protocols using USDT and USDC heavily in liquidity pools.

🔚 Conclusion :

This FATF alert puts SC under the global microscope.

It’s not a crackdown—it’s a demand for responsibility. Regulators want tools, not bans. And blockchain firms now face a choice: clean up or face heat.

As crypto adoption grows, can centralized stablecoins stay both fast and compliant?

With real-time monitoring and coordinated enforcement on the table, investors should watch what global regulators—and stablecoin issuers—do next.