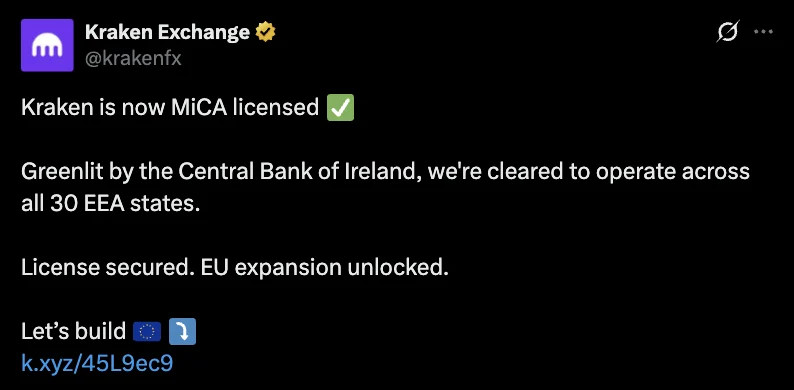

Kraken has been granted a MiCA license by Ireland’s central bank, allowing it to offer crypto services in all 30 European Economic Area countries. Kraken is one of the first major exchanges to comply with the new EU crypto framework.

What Happened

Yesterday, Kraken announced it had received a license under the MiCA regulation from the Central Bank of Ireland. This means the exchange can now offer regulated digital asset services across the entire EEA.

Kraken already had

- MiFID license in February 2025

- EMI license in 2023

“We believe trust is the most valuable currency in crypto, and it’s something you earn,” said Kraken co-CEO Arjun Sethi. “Our team has worked hard to meet the Central Bank of Ireland’s high standards.”

Market and Regulatory Insight

MiCA, fully enforced in 2024, is the EU’s answer to the fragmented crypto regulation that plagued member states for years. It creates uniform rules for crypto custody, token offerings, and stablecoin issuance.

With MiCA licenses, exchanges can now operate across EU countries without needing separate approvals in each country. That means Kraken’s Irish license is a gateway to 450 million EU consumers.

Other big players like Coinbase, OKX, Crypto.com, and Bybit have also gotten their MiCA licenses in 2025. Gemini is in the final stages of approval via Malta.

But not all are aligned with MiCA’s standards. Tether, issuer of the world’s largest stablecoin USDT, will not be registering for MiCA. That has led to delistings on some EU exchanges, as MiCA has strict stablecoin compliance rules.

Quotes

“We believe trust is the most valuable currency in crypto, and it’s something you earn,” said Kraken co-CEO Arjun Sethi. “Our team has worked hard to meet the [Central Bank of Ireland]’s high standards.”

Investor For investors, Kraken’s license means one less hurdle to access across the EU. With MiCA-compliant exchanges, users can expect more clarity, better protection, and stablecoin guarantees—especially as MiCA introduces caps and reserves on stablecoin volumes.

Kraken’s growing regulatory presence also makes it a prime candidate for future institutional partnerships or ETP offerings in Europe. As Binance faces scrutiny, Kraken’s playbook could attract more conservative capital looking for regulatory certainty.

This also means the EU is becoming a crypto-friendly zone—especially as U.S. regulators are split on stablecoin and exchange oversight.

U.S. Comparison

Kraken’s MiCA license came shortly after the exchange relocated its global headquarters to Wyoming, citing “pro-crypto policymakers and constructive regulations.”

But the U.S. remains behind on a national crypto framework. Key bills like the FIT21 Act and STABLE Act are still pending in Congress. Meanwhile, the SEC recently dropped its 2023 lawsuit against Kraken, which alleged the company was operating as an unregistered exchange.

That case withdrawal gives Kraken more breathing room in the U.S., but the MiCA license ensures a clearer path forward in Europe.

Conclusion

Kraken’s MiCA approval marks a major step in crypto’s regulatory maturity. As Europe builds out the world’s first unified crypto rulebook, U.S. exchanges are facing pressure to adapt—or move.

With Kraken now fully licensed in the EU, will others follow the MiCA path—or risk falling behind?