US Senator Cynthia Lummis expects Congress to pass two big crypto bills—the CLARITY Act and GENIUS Act—by the end of 2026. The proposed laws will bring clear rules for stablecoins and digital asset markets, a long-awaited move towards federal crypto regulation.

What Happened

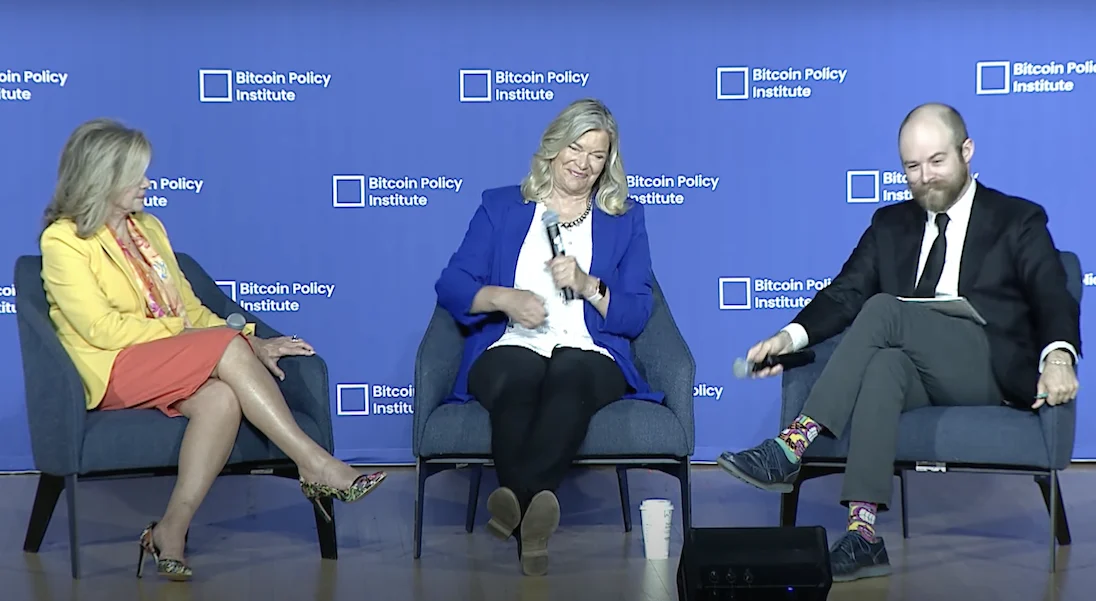

Speaking Wednesday at the Bitcoin Policy Summit in Washington, D.C., Senator Cynthia Lummis laid out a timeline for crypto legislation. She said the CLARITY Act (digital asset market structure) and the GENIUS Act (stablecoin regulation) could be passed “by the end of this year,” with full enactment by 2026.

Lummis, a Wyoming Republican and chair of the Senate Banking Committee’s digital asset subcommittee, has been a leading voice on crypto regulation. She acknowledged that bipartisan cooperation is tough, saying lawmakers on both sides are wary of how crypto laws may benefit politically connected individuals.

“I don’t want to come up with a piece of legislation that the other side of the aisle feels they haven’t had adequate input in,” Lummis said during a Tuesday hearing.

Market and Political Insight

The GENIUS Act—short for Guiding and Establishing National Innovation for US Stablecoins—passed the Senate on June 17 with 18 Democrats voting yes, 68 “yea” votes. The bill is now in the House of Representatives, where passage is uncertain.

The CLARITY Act, focused on digital asset definitions and jurisdiction between the SEC and CFTC, is moving through the House. But both bills face pushback from some Democrats who won’t move forward without addressing former President Donald Trump’s growing ties to crypto.

Trump, who has received donations from crypto executives and launched his own memecoin line, has said he would sign the GENIUS Act if passed “with no add-ons.”

Still, Lummis said she would be “extremely disappointed” if the two bills don’t reach the president’s desk by 2026, which is more measured than recent forecasts.

Quotes Section

“I don’t want to come up with a piece of legislation that the other side of the aisle feels they haven’t had adequate input in,” said Senator Cynthia Lummis.

Investor Angle If passed, the GENIUS Act would create the first federal framework for payment stablecoins—a move that would legitimize US-issued stablecoins and drive further adoption in crypto payments, DeFi, and tokenized assets.

Meanwhile, the CLARITY Act would resolve the SEC vs. CFTC debate over what is a security or commodity in crypto, a key issue for exchanges and token issuers.

For investors, clear laws would reduce regulatory uncertainty and bring in more institutional capital to compliant platforms and tokens. But any delay into 2026 would stall product development and ETF expansion for stablecoins and altcoins.

Conclusion

The U.S. crypto industry has waited years for clear laws. Now, with the CLARITY and GENIUS Acts in motion, the path to regulation is starting to take shape—but 2026 is still a long way off.

Will Congress bridge partisan divides—or will U.S. crypto firms keep looking to MiCA-regulated Europe for clarity first?