Michael Saylor’s firm now holds nearly 600K BTC, adding more amid rising market confidence.

Michael Saylor’s strategy has added 4,980 more Bitcoin to its stack, spending $531.1 million last week. The buy comes as Bitcoin rebounded above $107,000, signaling growing bullish sentiment.

The latest purchase brings Strategy’s total holdings to 597,325 BTC, acquired for $42.4 billion at an average price of $70,982 per coin. Strategy disclosed the buy in a June 30 SEC filing.

Why it matters

Strategy’s conviction buy shows that big players are still betting on Bitcoin—especially with prices nearing all-time highs. This latest move also reflects rising investor confidence in Bitcoin as inflation fears ease and institutional demand picks up.

Bitcoin traded around $101,000 on June 23 and climbed past $108,000 by week’s end, according to CoinGecko. Strategy paid an average of $106,801 per BTC during the period.

Year-to-date gains show strong momentum

With this addition, Strategy has increased its year-to-date Bitcoin stack by 85,871 BTC, valued at $9.5 billion. That compares to the 140,538 BTC gain seen in all of 2024 so far—worth about $13 billion.

The company’s YTD yield ticked up to 19.7%, just shy of its 25% target by the end of 2025. Its quarter-to-date yield also rose slightly to 7.8%, suggesting steady performance across its BTC portfolio.

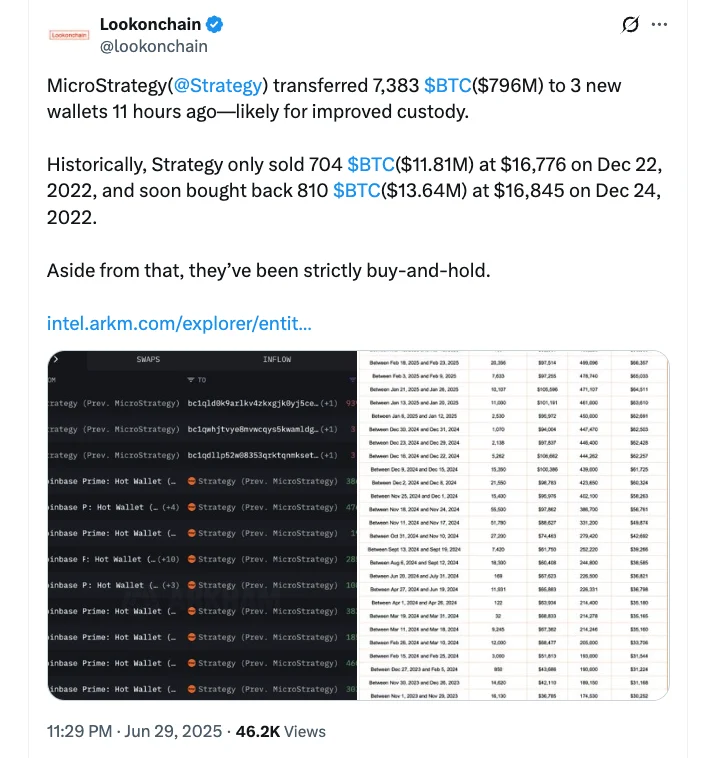

Custody shift raises questions.

Blockchain analysts flagged a 7,383 BTC transfer—worth roughly $796 million—by Strategy to three new wallets on Sunday. Data from Lookonchain suggests the move was likely part of an upgraded custody plan.

“Historically, Strategy only sold 704 BTC ($11.81M) at $16,776 on Dec. 22, 2022, and soon bought back 810 BTC ($13.64M) at $16,845 on Dec. 24, 2022,” Lookonchain noted.

“Aside from that, they’ve been strictly buy-and-hold,” the post added.

This aligns with Saylor’s long-standing strategy of holding Bitcoin as a long-term treasury reserve, rather than actively trading it.

Saylor: Still all-in on Bitcoin

Ahead of announcing the new buy, Saylor reposted a 2020 interview on X, recalling Strategy’s first BTC investment. The company began buying Bitcoin in August 2020, betting big on the asset’s long-term potential.

“I’m buying it for the dude that’s going to work for the dude that’s going to get hired by the guy who takes over my job in 100 years,” Saylor said.

“I’m not selling it. When it goes up by a factor of 100, I might be borrowing a little to go buy something that I want, but what am I going to buy with it that’s better than what I’m buying?”

Investor takeaway

Strategy’s aggressive accumulation continues to influence market sentiment. Traders are watching to see if other institutions follow suit, especially with Bitcoin near price discovery territory.

If momentum holds and Bitcoin pushes higher, Strategy’s play could strengthen the narrative that long-term holders still drive the crypto cycle.

What’s next?

Investors will be watching for macro catalysts like the next U.S. CPI print and the Fed’s rate outlook. Meanwhile, all eyes remain on ETF inflows and institutional activity as BTC flirts with $110K.

Will Bitcoin break out—or cool off before the next leg up?